How to Find

Discounted Property

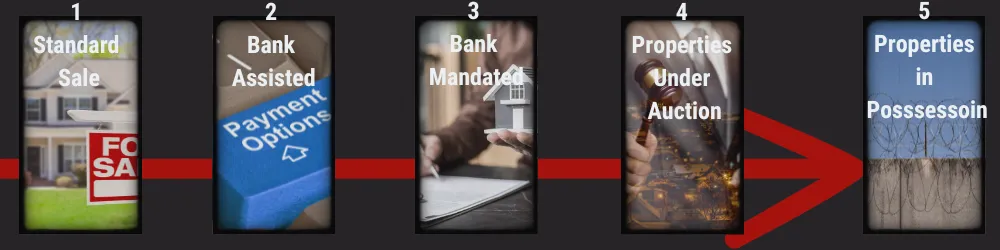

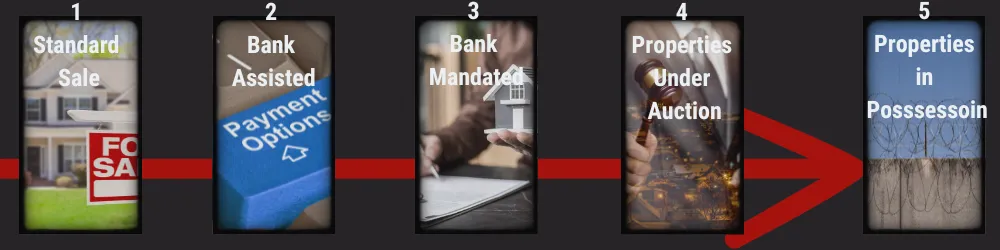

Navigating The Financially Distressed Property Chain for discounted properties

Prefer to watch instead of read?

A video walkthrough of this guide—showing how I apply it to real property deals—is included in the full course.

You’ll find the course details at the bottom of this page.

Table of Contents

Freedom of choice for you & your family

📑 Introduction - What is & how to Navigate the distressed property Chain.

🔍 Stages of the Distressed Property Chain in South Africa

📍 How to find these deals – even if you’re brand new

🧮 Opportunities and Risks

🔜Next steps you can take to get started

Introduction

And why this guide exists

Most of us know how to source properties on the open market through the Property portals of Property24 and Private Property.

And whilst there is nothing wrong with those properties, they don't always provide us with what we want and need

IE: Below Market Value Properties.

Today, I'll be walking you through the Distressed Property Chain which offers much more potential for deeper discounts the further right we go. From urgent sales, to Properties in Possession (PIP), each comes with the potential for deeper discounts, albeit at a deeper risk.

TAKE NOTE!

Remember, my aim as a Property Investor is to try and help people, and that includes stopping foreclosure where possible! The more I work to resolve problems for the seller, the more likely I am to get discounts. Foreclosures result in negative credit records for sellers, whereas selling to investors, avoids that.

The Financially Distressed Property Chain in South Africa

A financially distressed seller is someone facing financial difficulty and is often forced to sell quickly to avoid foreclosure or other financial consequences.

The Financially distressed seller will move through the distressed property chain in order to sell the property and remove the strain from the seller. With each stage comes different costs for the buyer and seller, and hence different risks, challenges, and opportunities.

Its important to note though, that the stages are not set in stone as each property and seller is different. For example, investors with larger portfolios may be given more leeway by the banks when it comes to tough times and will try to avoid foreclosure.

They have a bigger portfolio to protect.

In comparison, an investor with only 1 property, and unable to make payments, would have less exposure and the banks may press more for payment and quick sales.

Grant Cardone once described this as not having enough debt.

1 ~ THE STANDARD SALE - BUT URGENT

In the case of a seller entering financial difficulty, the seller has recognized their need to sell as they have missed 1 or 2 payments. The bank has made contact and are in discussion with the seller to let them know that after 3 missed payments, they will move to recoup there losses and encourage the seller into the "2 ~ Bank Assisted Sales" process.

Discounts I've received here: Typically 10% - 15% below market value

Who pays for what: The seller is liable for rates, taxes, levies, agent fees, electrical and water certificates as usual... But remember, I'm a problem solver. If it's a financially distressed property, the owner may not be able to afford these and as such, I'm looking for where I can take on the cost, at my risk, and because I'm doing that, would ask to be compensated through a lower purchase price.

OTP: At this stage I can still use my own OTP although most agents will push to use their template. Don't be shy to scratch out anything you do not like on their template, initial and send back.

The advantage for buyers is that I can speak directly to the seller. This makes things simpler, and allows for creativity with financing and price. I instruct my sourcing agents to look for these types of properties, as Sourcing agents find us through our investing website site www.zahomes.co.za and bring us great deals ... often before the property has hit the market. This is the method I used to make R500K profit and will discuss in a later how to guide

When a property like this comes to us, I almost always start with an ISA. It doesn't always get accepted, but it never hurts to ask.

Likewise, with estate agents, If, you are in their little black book of reliable investors, they may reach out to you before posting to the property portals, and Its the biggest reason I suggest keeping contact with several agents in your areas letting them know your hunting brief.

Alternately, keep a look out on the portals for properties described as "urgent sale" or "priced to sell" etc. We also market ourselves to Estate Agents as investors and we find that if the property is struggling to sell, they will also contact us - see below video that gets sent to agents

Automating your Hunting Briefs

When im looking for a new property, ill often create a video of my hunting brief and email this to agents and even other investors.

below is an exmpale of this

2 ~ BANK ASSISTED SALES

Also known as “distressed sales” or “assisted sales,” this stage happens when the bank works with the homeowner to sell the property voluntarily before legal repossession. Banks often list these through select estate agents at slightly below-market prices to encourage a quick sale - They will often be marked up as urgent sales on the property portals.

Discounts I've received here: Typically 10% - 30% below market value

Who pays for what: The seller is still liable for rates, taxes, levies, agent fees, electrical and water certificates etc. Banks may look at allowing an acknowledgment of debt when the sale price is below the outstanding debt with structured payment terms for the seller.

OTP: The use of my own OTP becomes trickier here and agents will often say they are mandated by the bank to use their templates. In which case, I will use theirs and just scratch out anything that is not required. There are only 5 caluses to make an OTP legally binding

The advantage for investors is that these deals usually come with cleaner paperwork than the rest to the distressed chain, but they may still carry urgency and require fast financing. Fast financing can usually allow for an ISA, or for creative financing which allows for discounts.

They are also properties that are often in good condition and can be bought at a discount, making them an attractive option for investors who want to avoid the renovation costs of physically distressed properties. But beware... things can and do go wrong as can be seen in the video below

Sales can take longer as bank approval is needed if there is a shortfall, and discounts may be smaller than at sheriff sales. This is how I bought the Bergvliet property and made over R100K in profit.

Caution: Properties can still have maintenance issues due to the seller’s financial distress so make sure to add time for a thorough due diligence in your OTP and don't let urgency distract you. Watch below for an example of an issue we only discovered after signing the OTP, but still within our due diligence period. And yes, we were able to offer the seller the option of fixing it, or lowering his price and we fix it.

3 ~ BANK MANDATED SALES

If a bank-assisted sale doesn’t succeed, the property can become bank-mandated.

Here, the bank has taken control of the sale mandate but the property is not yet in full possession of the bank. They typically appoint an estate agency panel to market and sell these properties on the bank’s behalf, and discounts are often more significant at this stage, as the bank is motivated to avoid a full repossession.

Discounts ive a

Who pays for what: Whilst the seller remains technically liable for rates, taxes, levies, and compliance certificates, distressed owners rarely have the funds to cover these. In practice, the bank can step in to settle arrears and arrange certificates, ensuring the property can transfer. Agent fees are paid by the bank, while the buyer remains responsible for transfer costs. This makes bank-mandated properties cleaner and less risky than sheriff sales, and again can offer an even deeper discount as the banks are more keen to protect against financial loss than they are financial gain.

OTP: You have to use the bank mandated agent OTP and trying to amend the OTP only results in delays and issues for you. This leads to frustration as the banks will very rarely accept any changes.

ISA's are possible here, but often tricker to negotiate as the bank is looking for a clean sale and heavily influence the process. Its my least favorite of the pre auction phases for these two reasons.

The advantage for buyers is that most buyers are not investors, and are uncomfortable in this space. Don't be put off by this though, deep discounts can be found here by visiting their bank assisted sale websites and making an offer. Remember, its your offer price, not the banks asking price.

4 ~ PROPERTIES UNDER AUCTION

The sale hasn't happened. Not via a standard sale, not via a bank assisted, and nor via a bank mandated. And it now moves to an auction. Iv not bought at an auction before and don't see myself doing so. Each time I attend, it just feels like a desperate attempt at taking advantage of someone who clearly needed help.

Discounts I've received here: None. Its not a market I like. But, I've been to enough auctions and have seen properties sell off at a whopping 70% below market value!

Some banks run their own auctions, either online or through auction houses, to sell distressed property quickly. Compared to sheriff auctions, bank auctions are usually more transparent, with proper due diligence packs and access for viewings. Investors can pick up bargains, but competition can be fierce, and properties are still sold “as-is,” meaning risks of hidden costs remain.

As mentioned, Sheriff auctions are not for me

Who pays for what: The seller is still liable for rates, taxes, levies, agent fees, electrical and water certificates etc.

OTP: It's at an auction so your bidding, not making an offer. See more below though on submitting an OTP.

The advantage for buyers is that you can still submit an OTP. To do this, don't go via the auction, approach the seller and bank and submit an OTP directly which can be done right right up until the time the hammer falls on a sale.

I cannot use my own OTP here

Auctioned properties can be either physically distressed or financially distressed. The auction process can be competitive, and investors need to be prepared to act quickly. It's important to secure financing in advance, as auction sales often require immediate payment.

5 ~PROPERTIES IN POSSESSION

5. Property in Possession (PIP)

Finally, if all else fails, the bank repossesses the property completely — these are called Properties in Possession (PIP). At this point, the bank is the legal owner and typically sells the property directly through its repossessed property department. PIPs are often the safest distressed deals for investors: transfer fees are usually covered by the bank, outstanding rates may be cleared, and the bank is motivated to dispose of the asset. However, discounts are not always as deep as earlier stages, since the bank is managing the sale in a more controlled way.

Similar to above, Its not a space I like to operate in and have not bought property through this medium. At this point your negotiating with a bank who can be very rigid and that does not offer me the flexibility I need.

Opportunities and Risks for Investors

Both distressed properties and financially distressed properties offer unique opportunities and risks for investors in South Africa:

1. Distressed Property

For investors with experience in property renovations, distressed properties offer the chance to purchase below market value, invest in necessary repairs, and either flip the property for a profit or rent it out for steady income. These properties are commonly found at auctions or through bank-mandated sales.

The main risk with distressed properties is the potential for renovation costs to spiral out of control. Structural problems, compliance issues, or hidden defects may only become apparent after purchase. Additionally, auctioned properties often require immediate financing, leaving little time for due diligence.

2. Financially Distressed Property

For investors seeking quicker transactions and fewer upfront repair costs, financially distressed properties present a simpler opportunity. These properties are usually sold below market value by motivated sellers or through bank-assisted sales, where the condition of the property is typically sound.

The key risk with financially distressed properties is the legal or financial complications that may accompany the sale. These properties may have unresolved debts that need to be settled before the sale can proceed. You can also end up with squatters

at auctoins yuo get banks bidding on their own properties and syndicates operating

Both distressed and financially distressed properties offer compelling investment opportunities, but they come with different challenges and rewards. Find what risk appetite you have and

Distressed properties offer the potential for significant upside if you have the skills and resources to handle renovations. They can often be acquired at auctions or through bank-mandated sales, but investors should be prepared for higher risks and hidden issues.

Financially distressed properties provide a faster path to acquisition with fewer immediate costs, as they are often sold by distressed sellers or through bank-assisted sales. These properties are typically in good condition, making them an attractive option for investors who want to avoid major

Ready to Take Your property Investing knowledge to the Next Level?

Ready to Stop Guessing and Start Building?

Enroll Today & Build Your Business the Right Way

You don’t have to do this alone. This course is your shortcut to clarity, confidence, and consistent growth. Every step is laid out — you just need to take action.

Who Is Michael Bowen?

Testimonials

“Michael’s a seasoned property investment expert, a property professional brilliant at cash-flow-positive real estate investing, an energising businessman, and inspirational speaker and coach.”

Ronel Jooste

FinanciallyFitLife

“It’s not just about making money but learning during the process. Michael imparted so much knowledge to me, which let me break through the ceiling and move my property game to the next level.”

Heinrich Killian

Investor

“I 100% recommend investing with Michael. He is honest, reliable and impressively persevering. There’s no better place to put your money to generate a sustainable passive income over time.”

Nick Koupman

Investor

Facebook

Instagram

X

LinkedIn

Youtube